Whatsapp integrators

official partner

Start engaging with your customers where they already are.

Trusted by leading brands

WIP

GotBot & WhatsApp. Choose your plan.

Transforming

big business,

one conversation

at at time.

Focusing on the Financial services, Insurance,

Retail & Property sectors, GotBot Ai is here to take your business to new heights.

See our case studies below

Transforming

big business,

one conversation

at at time.

Focusing on the Financial services, Insurance,

Retail & Property sectors, GotBot Ai is here to take your business to new heights.

See our case studies below

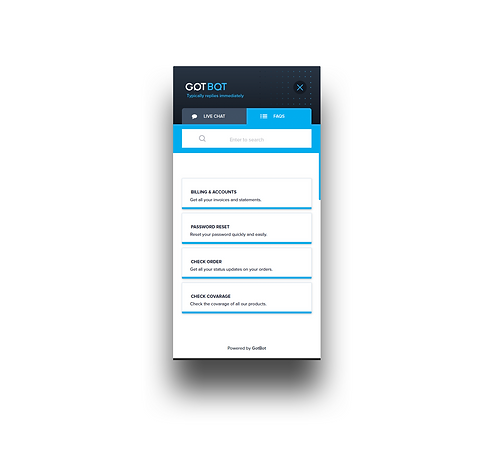

Automate responses across multiple

messaging services from

a single dashboard.

Automate responses across multiple

messaging services from

a single dashboard.

Automate responses across multiple

messaging services from

a single dashboard.

Meet your new Insurance Agent.

Insurance companies with chatbots can expect to streamline their operations and undergo an efficient digital transformation.

With more than 89% of users looking to message a company rather than make a phone call, without a bot you’re missing out on qualified leads and conversions.

Approximately 3.5 billion people are using messaging apps for communications. This allows chatbots to make your business accessible 24/7, without the overhead costs.

Benefits of GotBot Ai in the Insurance Industry.

-

Customer Awareness & Education

-

Claim Processing & Payment Assistance

-

Lead Profiling and Conversion

-

Customer Feedback & Review

-

Rich Database

Customer Awareness & Education

Chatbots can answer those FAQs to help customers understand your insurance products better, on their platform of choice.

Claim Processing & Payment Assistance

Use your chatbot to process information and claims. You can also set the bot to automatically follow up for additional info or payments.

Lead Profiling and Conversion

Through automated questions and immediate answers, your bot can profile and segment customers to qualify leads and improve the chances of conversions.

Rich Database

Every message through your bot has the potential to grow your database. In line with GDPR and POPIA, you can capture contact details for re-marketing efforts.

Want to know how chatbots and machine learning can work for your Insurance business?

Register for a Free Strategy Session

GotBot Ai is,

Always clear &

effective 24/7 support

As chatbots are not people, they're available 24/7 to assist, at a consistent function. Most importantly, the message is always clear and correct, minimising errors or misinformation.

Integrated

Consistency is key. Your chatbot can integrate with several data sources to ensure that information like quotations are consistent, updated and correct across platforms.

Secure & Compliant

As the insurance industry deals with sensitive data, GotBot Ai offers sophisticated technology that complies with POPIA and GDPR and also integrates with a centralised authentication system for added security.

24/7 Insights

& Analysis

Your chatbot is continuously analysing what is and is not working and using this data allows the bot to optimise questions and responses to enhance individual customer experiences.

Multichannel & Consistent

with messaging

Tailor the conversation to these individual markets, across multiple platforms but managed on one dashboard.

GotBot Ai can be integrated across your communications while syncing all information onto one dashboard for monitoring, streamlining and executing your service.

Reporting

GotBot Ai boasts, seven different reporting modules give businesses the power to make informed decisions.

All reports can be downloaded in both raw and formatted modules.

Automate processes

Connect APIs for end-to-end process automation.

Around 60% of an agent's time is spent searching through backend systems. Free up your agents by connecting your APIs to automate common actions, like checking claims and policy schedules, downloading statements and premiums.

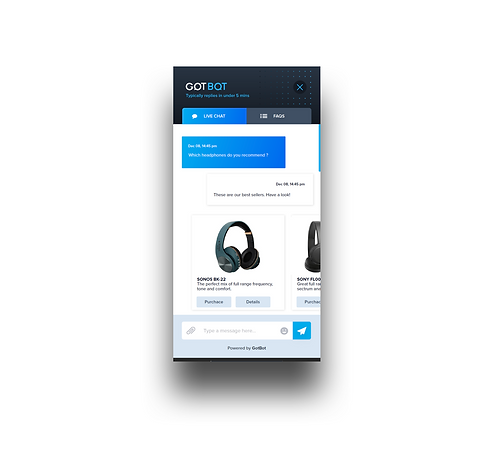

Product Search

Let your customers browse your products directly in chat.

Connect GotBot Ai to your product offerings to find insurance products and guide buying decisions and claims right when your customers want it most. Process and automate sales and claims 24/7 to help agents keep up with demand.

Agent Handover

Handoff complex cases and sales opportunities to agents seamlessly.

GotBot Ai integrates into your existing CRM/ERP/Call centre software. The GotBot Ai platform helps understand when a customer service agent is needed and loops them in with ease. Keep customer experiences exceptional, with seamless insurance agent handoffs for key customer requests.